The Indo-Pacific and India: Trade, Power and Maritime Reality in 2026

Feb 7, 2026

The Indo-Pacific is no longer a diplomatic phrase used in joint statements. It has become the central arena of global economic and strategic competition.

Measured by trade flows, port activity and naval deployments, this region now carries the weight of global commerce. For India, whose economy depends overwhelmingly on maritime transport, what happens across these waters is not peripheral. It is structural.

Maritime Trade Still Drives the Global Economy

Global trade remains deeply maritime. According to UNCTAD’s Review of Maritime Transport 2025, seaborne trade reached roughly 12.7 billion tons in 2024, with growth of just over 2 percent that year. Even amid slower global expansion, the world continues to rely on ships to move goods.

Around 80 percent of global merchandise trade by volume travels by sea. That figure has remained remarkably consistent for decades. Shipping is not an optional layer of globalization. It is the foundation.

For India, this reality is even more pronounced. Government data indicate that roughly 95 percent of India’s trade by volume and about 70 percent by value moves through maritime routes. Ports are not logistical details. They are economic lifelines.

Chokepoints Define Strategic Risk

Few routes illustrate this concentration better than the Strait of Malacca. Roughly 40 percent of global trade by value passes through this narrow corridor each year, with tens of thousands of vessels transiting annually.

The strait connects the Indian Ocean to the South China Sea and the Pacific. Energy shipments from the Middle East, manufactured goods from East Asia, and commodities bound for Europe and Africa all converge there.

For India, this chokepoint is not abstract geography. Disruption along this route, whether from conflict, piracy, climate events or strategic rivalry, would have immediate economic consequences. Trade exposure magnifies strategic vulnerability.

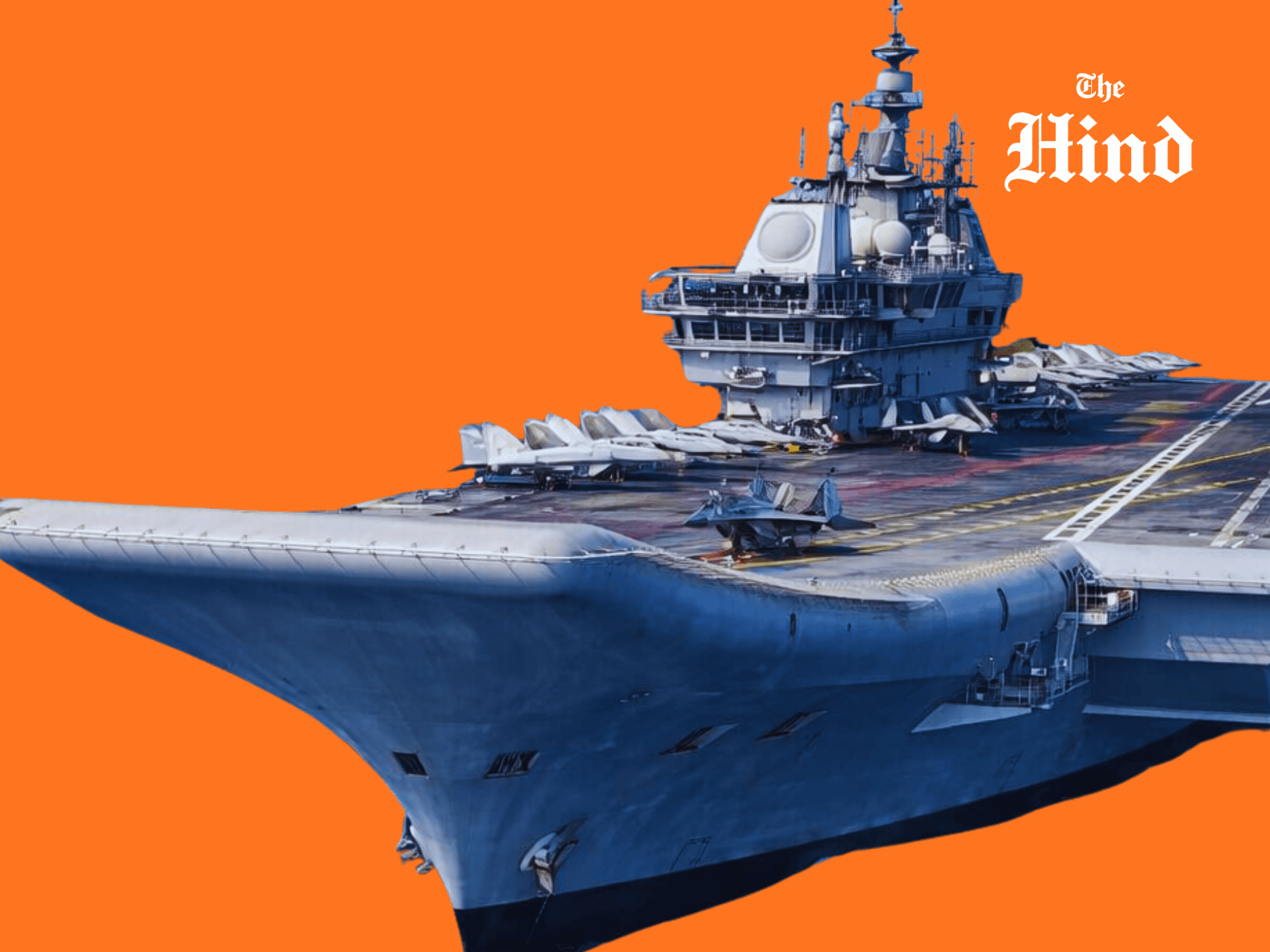

India’s Expanding Maritime Footprint

India’s own port capacity reflects rising trade intensity. Major Indian ports handled roughly 855 million tonnes of cargo in FY 2024–25, up from the previous year. Container traffic and bulk cargo movement continue to expand as infrastructure upgrades under national development plans take effect.

This growth is not simply about volume. It is about positioning. Port modernization, logistics corridors and coastal connectivity are part of a broader strategy to embed India more deeply into regional supply chains.

In a region where trade equals influence, maritime infrastructure becomes a strategic asset.

The Region’s Economic Weight

The Indo-Pacific includes many of the world’s largest economies: the United States, China, India, Japan, ASEAN states, Australia and South Korea. Collectively, these economies account for roughly 60 percent of global GDP and a similar share of global population.

This concentration explains why strategic competition is intensifying here. Trade, technology supply chains and naval deployments intersect across the same geography.

The Indo-Pacific is not important because of rhetoric. It is important because economic gravity is concentrated here.

Naval Presence and Strategic Competition

Economic centrality inevitably attracts military attention. The United States and China maintain the largest naval presences in the region, and China’s fleet has expanded significantly in recent years in both size and capability. Regional groupings such as the Quad, involving India, the United States, Japan and Australia, have increased coordination through joint exercises and interoperability initiatives.

Trade routes and naval power now operate in parallel. Economic security and maritime security have merged.

Strategic Implications for India

Trade Security Is Maritime Security

India’s external sector performance depends on uninterrupted sea lanes. Recent trade releases show continued export growth, reinforcing how closely India’s economic stability is tied to maritime continuity.

Securing sea lines of communication is therefore not only a defense objective but an economic necessity.

Chokepoints Amplify Exposure

The concentration of global trade through narrow passages such as Malacca magnifies risk. Diversification of routes, strategic partnerships, and naval readiness are not optional hedges. They are safeguards against systemic disruption.

Infrastructure Is Strategic Leverage

India’s rising port throughput reflects growing integration into global commerce. Continued investment in port efficiency, logistics corridors and coastal infrastructure strengthens India’s bargaining position in regional trade networks.

Maritime infrastructure is no longer just about facilitating trade. It is about shaping it.

Conclusion

The Indo-Pacific has become the central artery of global trade and strategic rivalry. Verified maritime data confirm that shipping carries the overwhelming majority of global goods, that trade volumes continue to expand, and that key chokepoints sustain economic continuity.

India’s own trade profile is overwhelmingly maritime. Its ports are growing. Its exposure is real.

For India, the lesson is clear. Maritime security, infrastructure modernization, naval capability and economic diplomacy must move together. The Indo-Pacific will define not only trade routes, but the balance of influence in the decades ahead.

In this century, geography has returned to the center of power. For India, that geography is maritime.

Type something …

Search